Last week's mortgage rates end near best levels for 2017

Mortgage Rates Improve

Mortgage rates have seen a nice improvement over the past week. Weaker than expected wage inflation data, favorable comments from global central bankers, and uncertainty about government policies in the U.S. contributed to the improvement. Mortgage rates ended the week near the best levels of the year.

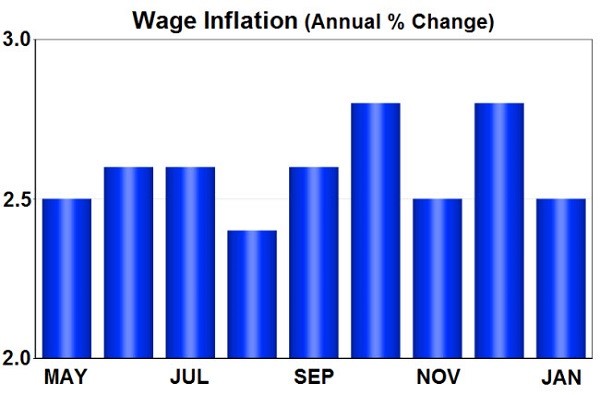

Wage growth in December jumped to much higher than expected levels, raising investor concerns about future wage inflation. On Friday, however, these worries were eased. The important monthly Employment Report revealed that the annual rate of wage inflation in January was just 2.5%, down from 2.9% as originally reported in December. In addition, the December reading was revised a little lower. Since mortgage rates are closely tied to expectations of future inflation, the January wage data was favorable for rates.

Expectations for inflationary policies from the Trump administration were a major factor in the increase in mortgage rates since the election. Recently, though, investors have questioned if the policy changes might take longer than expected to implement. This has reduced the outlook for future inflation and has added demand for bonds.

In recent weeks, investors had become more concerned that the U.S. Fed and the European Central Bank (ECB) may tighten monetary policy at a faster than expected pace. Over the past week, however, comments from Fed and ECB officials reduced these fears. Since tighter monetary policy would reduce the demand for bonds from central banks, a slower pace is good for mortgage rates.

Looking ahead, Fed Chair Yellen will be delivering her semi-annual testimony to Congress on February 14 and 15. Comments about the outlook for future monetary policy could affect mortgage rates. Retail Sales and the Consumer Price Index (CPI) will be released on February 15. Consumer spending accounts for about 70% of economic output in the U.S., and the Retail Sales data is a key indicator. CPI, a widely followed monthly inflation report, looks at the price change for goods and services that are purchased by consumers.

Contact us to discuss how we can help your clients with their mortgage needs.

Commentary provided by MBSQuoteline. For live MBS pricing visit www.mbsquoteline.com.

This letter is for information purposes only and is not an advertisement to extend customer credit as defined by Section 12 CFR 1026.2 Regulation Z. Program rates, terms and conditions are subject to change at any time. Licensed by the Department of Business Oversight under the California Residential Mortgage Lending Act, 4131316 NMLS #237653