Labor market data stronger than anticipated

Labor Market Data Improves

After a couple of quiet days, this week quickly took a turn for the worse for mortgage rates on Wednesday. Stronger than expected labor market data caused mortgage rates to move higher.

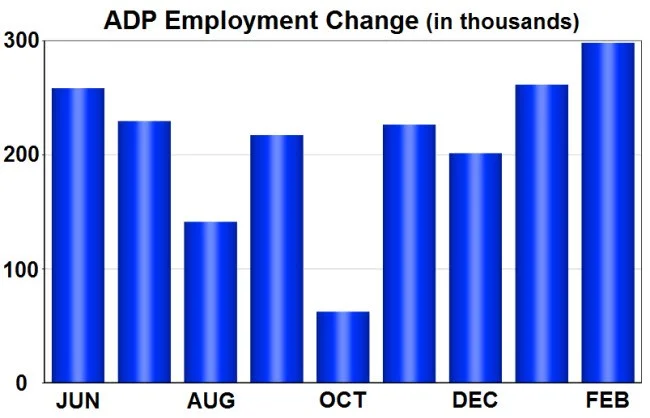

ADP, a private payroll company, released an estimate of private sector job gains two days before the key monthly Nonfarm Payroll Report from the Bureau of Labor Statistics (BLS). While the two reports vary widely in some months, big surprises in the ADP report often shift investor expectations for the BLS report. On Wednesday, ADP estimated that the economy added 298,000 private sector jobs in February, far above the expected level of 190,000, and the figures for January were revised higher. This was the largest monthly increase since April 2014, and the gains were well distributed between services, construction, and manufacturing. This data was great news for the economy. However, since stronger economic activity raises the outlook for future inflation, the report was bad for mortgage rates.

The strong labor market data also caused investors to expect a faster pace of monetary policy tightening from the Fed. As indicated in futures markets, investors now price in roughly a 90% chance of a rate hike at the meeting on March 15, up from about 25% just two weeks ago. Over the last couple of weeks, investors also have raised their outlook for the total number of rate hikes in 2017. Loose monetary policy has been good for mortgage rates in recent years, so a faster pace of tightening is viewed as negative.

The next couple of days will be big for mortgage markets. There will be a European Central Bank (ECB) meeting on Thursday. No change in policy is expected, but the statement likely will influence U.S. markets. In the U.S., the key Employment Report will come out on Friday. As usual, this report on the number of jobs, the unemployment rate, and wage inflation will be the most highly anticipated economic data of the month. As mentioned, the next U.S. Fed meeting will take place on March 15, and a rate hike is widely expected.

Contact us to discuss how we can help your clients with their mortgage needs.

Commentary provided by MBSQuoteline. For live MBS pricing visit www.mbsquoteline.com.

This letter is for information purposes only and is not an advertisement to extend customer credit as defined by Section 12 CFR 1026.2 Regulation Z. Program rates, terms and conditions are subject to change at any time. Licensed by the Department of Business Oversight under the California Residential Mortgage Lending Act, 4131316 NMLS #237653