A Refi Can Fuel Your Renovation.

Do you realize your home equity can be one of

your greatest financial resources?

It's true that as you pay down your mortgage, you build equity (the amount of your home you actually own). But as your home appreciates in value each year, it also helps you build equity without having to lift a finger. This equity becomes a valuable asset you can leverage to help you meet other financial needs.

The Power of Appreciation

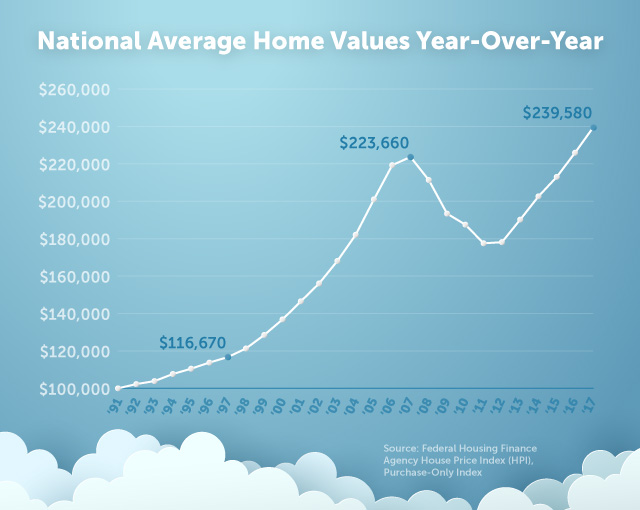

Since 1991, home values have increased an average of 3.3% each year, according to the Federal Housing Finance Agency's (FHFA) House Price Index (HPI). Just in the past year, home prices went up an average of 6.0% across the country.

The chart below shows how home prices have generally risen over the past 26 years. As you can see, current home values have bounced back well over the peak of the housing bubble. That means, based on appreciation alone, there's a good chance that you may have equity to tap into.

In other words, you could be sitting on a pile of cash.

Cash Out Your Equity, Meet Your Goals!

Saving up enough money to meet your financial goals can take years. By refinancing your home, you can cash out your equity and use it for whatever you need, while taking advantage of today's historically low interest rates.

So how do you do it?

Until recently, borrowing money for a new kitchen, master bath, second-story addition, or other home improvement meant going to the bank, seeing a loan officer, and hoping for the best. Today, however, you have many more options. A mortgage loan officer, for example, can offer more than 200 different loan programs.

That means you might be able to borrow more money than you think. But with so many competing lenders, loan options, and terms, it also means loan shopping can be as challenging as house hunting. You can skip all the confusion by working with Franklin Loan Center.

Franklin Loan Center has courteous, knowledgeable and professional loan officers that will treat your loan like it's their own. They can assist you in finding the loan that is right for your project. But first, you must take a few steps.

Figure out what you would like to renovate. Is it your Kitchen? Add another room to your home? Renovate your master bath and get that large rain shower you always wanted?

Price out your renovation. How much will materials cost? Get contractors to come in and give you bids on the cost of the renovation. Get an estimate on how much permits may cost.

Contact your nearest Franklin Loan Center to meet with one of our Loan Officers to assist you with your refi needs.

A home refi can fuel your renovations and you can use the equity in your home to help you build even more equity by reinvesting it into your house. It can also help with purchasing a new car, paying for your kids college, taking that vacation you've been needing or a host of anything else you might need the money for. There are many different refi options such as a cash out refi, home equity loan, HELOC, and many more. Speaking to a knowledgeable Loan Officer is instrumental in finding the right loan for what you want to do with the cash from your equity.